All Categories

Featured

Table of Contents

Prostock-Studio/ GOBankingRates' content group is devoted to bringing you unbiased testimonials and information. We use data-driven techniques to evaluate financial services and products - our reviews and ratings are not affected by advertisers. You can find out more about our content standards and our items and solutions examine method. Limitless banking has actually caught the passion of several in the personal financing world, assuring a path to financial liberty and control.

Limitless banking refers to a financial approach where an individual becomes their own lender. The insurance policy holder can borrow against this cash money worth for different financial requirements, successfully lending cash to themselves and repaying the policy on their very own terms.

This overfunding increases the development of the plan's cash money value. Boundless banking supplies lots of benefits.

What type of insurance policies work best with Policy Loan Strategy?

Right here are the responses to some inquiries you could have. Is unlimited financial reputable? Yes, boundless banking is a reputable technique. It involves utilizing an entire life insurance policy plan to create an individual funding system. Its performance depends on numerous factors, consisting of the plan's structure, the insurance policy firm's efficiency and exactly how well the method is managed.

How much time does limitless financial take? Unlimited banking is a long-term method. It can take several years, frequently 5-10 years or even more, for the money worth of the policy to grow adequately to start borrowing versus it effectively. This timeline can differ depending on the plan's terms, the costs paid and the insurance coverage company's efficiency.

Is Life Insurance Loans a good strategy for generational wealth?

As long as costs are present, the policyholder merely calls the insurance coverage firm and demands a lending against their equity. The insurer on the phone will not ask what the financing will be made use of for, what the earnings of the borrower (i.e. policyholder) is, what other assets the individual might have to function as security, or in what duration the person plans to pay back the lending.

In contrast to label life insurance policy items, which cover only the beneficiaries of the insurance holder in the occasion of their death, whole life insurance covers a person's whole life. When structured properly, whole life plans produce a special revenue stream that raises the equity in the plan over time. For more reading on how this works (and on the pros and disadvantages of whole life vs.

In today's world, one driven by convenience of ease, too many as well several granted our provided's country founding principlesStarting freedom and justice.

What is the best way to integrate Borrowing Against Cash Value into my retirement strategy?

Lower financing passion over policy than the traditional funding products get collateral from the wholesale insurance plan's cash or abandonment worth. It is a concept that allows the policyholder to take finances on the whole life insurance policy plan. It should be offered when there is a minute financial problem on the person, in which such loans may assist them cover the monetary lots.

The policyholder requires to link with the insurance coverage business to ask for a finance on the policy. A Whole Life insurance plan can be labelled the insurance policy item that gives security or covers the individual's life.

The plan might call for regular monthly, quarterly, or yearly payments. It begins when a specific occupies a Whole Life insurance policy policy. Such plans might invest in corporate bonds and federal government safeties. Such policies keep their values because of their conventional strategy, and such plans never spend in market instruments. As a result, Boundless banking is a principle that allows the policyholder to use up fundings overall life insurance policy plan.

What is the long-term impact of Infinite Banking Benefits on my financial plan?

The cash or the abandonment worth of the whole life insurance serves as security whenever taken lendings. Mean a private enrolls for a Whole Life insurance coverage policy with a premium-paying term of 7 years and a policy duration of twenty years. The individual took the plan when he was 34 years old.

The financing rates of interest over the plan is somewhat less than the traditional finance products. The collateral stems from the wholesale insurance coverage's cash or abandonment worth. has its share of advantages and drawbacks in terms of its basics, application, and functionalities. These aspects on either extreme of the spectrum of facts are reviewed listed below: Boundless financial as a financial development enhances capital or the liquidity profile of the insurance holder.

Wealth Management With Infinite Banking

The insurance plan loan can also be offered when the person is out of work or dealing with health issues. The Whole Life insurance coverage plan maintains its total value, and its performance does not link with market efficiency.

In addition, one must take just such plans when one is financially well off and can handle the plans costs. Infinite financial is not a fraud, but it is the ideal point most people can decide for to enhance their monetary lives.

Infinite Banking

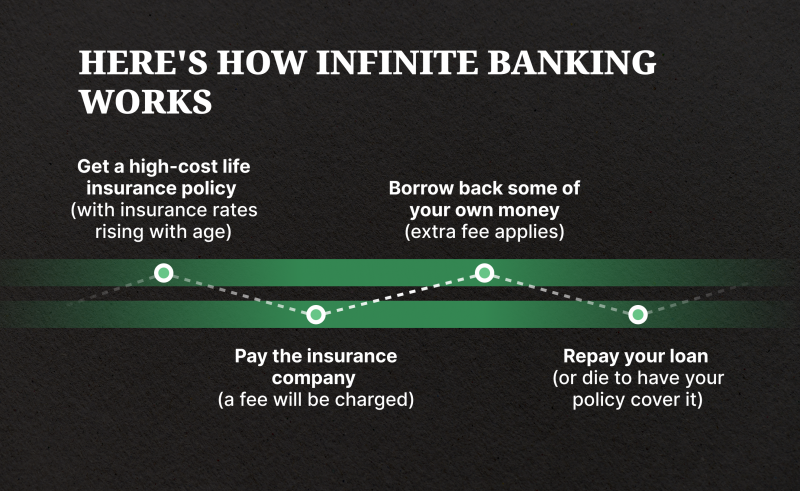

When individuals have infinite financial discussed to them for the initial time it appears like a wonderful and risk-free way to grow wealth - Financial leverage with Infinite Banking. The idea of changing the disliked bank with borrowing from yourself makes a lot even more sense. It does call for changing the "disliked" financial institution for the "disliked" insurance business.

Of program insurance companies and their agents enjoy the idea. They created the sales pitch to sell more whole life insurance.

There are no items to acquire and I will market you nothing. You maintain all the cash! There are 2 severe monetary catastrophes developed into the limitless financial idea. I will subject these imperfections as we work with the math of how boundless financial really works and how you can do better.

Table of Contents

Latest Posts

Is there a way to automate Infinite Banking transactions?

How long does it take to see returns from Policy Loan Strategy?

How can Leverage Life Insurance reduce my reliance on banks?

More

Latest Posts

Is there a way to automate Infinite Banking transactions?

How long does it take to see returns from Policy Loan Strategy?

How can Leverage Life Insurance reduce my reliance on banks?